In community property states, most property acquired during marriage (except for gifts or inheritances) is considered community property (owned jointly by both partners) and is divided upon divorce, annulment, or death. Separate property is owned by one spouse only. It is property that a spouse brings into the marriage or receives via gift or inheritance during the marriage. Unless there is specific evidence to the contrary, the law assumes all assets belonging to a couple are community property. The community property system is usually justified by the idea that such joint ownership recognizes the theoretically equal contributions of both spouses to the creation and operation of the family unit.

In states that do not have community property laws, assets are owned by whoever’s name appears on the deed or registration.

Comparison chart

| | Community Property | Separate Property |

|---|---|---|

| Definition | Property acquired while married and residing in a community property state is owned by both spouses. | Property owned before marriage or received via inheritance during marriage. Is owned by only one spouse. |

| Examples | Wages, salaries, housing, investment income, including income from separate property. | Gifts, inheritances, property acquired in one named and never used to benefit other spouse, income from IRAs, 401(k)s or retirement accounts, Social Security Benefits |

| Tax Reporting | Each spouse reports 50% of total community income on their tax return when filing separately. | Each spouse reports 100% of their individual (separate) income on their tax return when filing separately. |

| States | Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin | All states |

| Financial Planning Considerations | In the case of a separation or divorce, each spouse is legally entitled to exactly half of the communal property, regardless of who acquired it. | Not divisible in a divorce - remains the property of one spouse. |

What is Community Property and Community Income?

Community property includes most property that was acquired while married and residing in a community property state. It includes wages, salaries and self-employment income, as well as assets such as houses and cars. Investment income from assets that are community property is also considered in this category.

Separate property was either owned separately before marriage, bought with separate funds (and never used for the benefit of the partner) or is property that both spouses have agreed to convert to separate property through a legally valid spousal agreement. It can include gifts received by one spouse during or before marriage, property acquired in spouse’s name and never used for benefit of other spouse, inheritances, and certain personal injury awards. Investment income from separate property is considered separate income.

Examples

- Wages, salaries and self-employment income are community property, as are any interest, rent, or dividends earned on community property.

- Income from individual retirement accounts (IRAs) is always separate income, as are social security benefits.

- Any interest, rent or dividends earned on separate property is considered separate income in most states, but is considered community income in Idaho, Louisiana, Texas and Wisconsin.

- For 401(k) plans and other types of pension, the income is divided into community and separate income based on the length of participation in the pension and the length of the marriage. For example, if an individual participated in a pension scheme for 30 years and was married for 15 of those years, 50% of that income is community income.

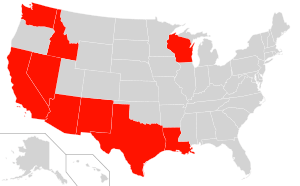

Community Property States

Community property laws exist in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Tax Reporting

If filing for taxes in separate returns (married, filing separately) each spouse should report 50% of the value of their community income and 100% of the value of their separate income on their tax return.

Separation

Separation  Annulment

Annulment  Attorney Fees

Attorney Fees  Stocks

Stocks  Lawyer

Lawyer  Mediator

Mediator

Comments: Community Property vs Separate Property