Companies can raise capital via debt or equity. Equity refers to stocks, or an ownership stake, in a company. Buyers of a company's equity become shareholders in that company. The shareholders recoup their investment when the company's value increases (their shares rise in value), or when the company pays a dividend. Buyers of a company's debt are lenders; they recoup their investment in the form of interest paid by the company on the debt.

It is often easier for companies to raise money through debt, as there are fewer regulations on debt issuance, the risk for an investor (lender) is generally lower, and a company's assets can be used as collateral.

Comparison chart

How to Raise Capital

Secured loans are commonly used by businesses to raise capital for a particular purpose (e.g., expansion or remodeling). Similarly, credit cards and other revolving lines of credit often help businesses make everyday purchases that they may not be able to currently afford but know they will be able to afford soon. Some companies, particularly larger ones, may also issue corporate bonds.

Raising capital with equity is known as equity financing. Company shares are sold to others who then gain an ownership interest in the company. Smaller businesses who take advantage of equity financing often sell shares to investors, employees, friends, and family members. Larger companies, such as Google, tend to sell to the public through stock exchanges, like the NASDAQ and NYSE, after an initial public offering (IPO).

An important part of raising capital for a growing company is the company's debt-to-equity ratio — often calculated as debt divided by equity — which is visible on a company's balance sheet.

Debt vs. Equity Risks

Any debt, especially high-interest debt, comes with risk. If a business takes on a large amount of debt and then later finds it cannot make its loan payments to lenders, there is a good chance that the business will fail under the weight of loan interest and have to file for Chapter 7 or Chapter 11 bankruptcy.

Equity financing avoids such risks and has many benefits, but giving others an ownership stake in a business can be risky; the less valuable a business is, the more ownership an investor might demand, a fact that may prove costly. Moreover, equity financing is tightly regulated to protect investors from shady operations, meaning that this method of raising capital is initially expensive and time-consuming with the need to involve lawyers and accountants. As such, debt is a much simpler way to raise temporary or even long-term capital.

However, raising capital with debt is not always possible. During recessions, credit can be hard to come by as banks become reluctant to lend money or only loan money at very high interest rates. In the 2008 financial crisis, for example, small businesses were often denied credit and forced to seek equity financing options.[1]

Costs of Debt vs. Equity

Outside of the cost of interest, there are few expenses associated with capital raised via debt. In 2012, the average small business loan in the United States was for just under $338,000, and the average interest rates for those loans were somewhere between 2.25% and 2.75%, depending on the length of the loan.[2] Credit cards have much higher interest rates. Even with a good credit history, most credit cards will have an 11% APR or higher.

Raising capital via equity financing can be an expensive endeavor that requires experts who understand the government regulations placed on this method of financing. When investors offer their money to a company, they are taking a risk of losing their money, and therefore expect a return on that investment. Their expected return is the cost of equity. A percentage of potential company profits is promised to investors based on how many shares in the company they buy and the value of those shares. So, the cost of equity falls on the company that is receiving investment funds, and can actually be more costly than the cost of debt for a company, depending on the agreement with shareholders.

Cost of Equity and Cost of Capital

Cost of capital is the total cost of funds a company raises — both debt and equity. The weighted average cost of capital (WACC) takes into account the amounts of debt and equity, and their respective costs, and calculates a theoretical rate of return the business (and, therefore, all its projects) must beat.

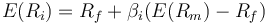

As explained above, in order to calculate the cost of capital, one must calculate the cost of debt and the cost of equity. Determining the cost of debt is fairly easy because interest rate on the debt is known. Calculating the cost of equity is trickier; there are several models proposed to calculate it. One such model is the Capital Asset Pricing Model (CAPM). Per this model,

where:

-

is the return expected by the equity investor, i.e. the cost of equity

is the return expected by the equity investor, i.e. the cost of equity

-

is the risk-free rate of interest, e.g. yield of a U.S. Treasury bond

is the risk-free rate of interest, e.g. yield of a U.S. Treasury bond

-

(the beta), the sensitivity of the expected excess asset returns to the expected excess market returns

(the beta), the sensitivity of the expected excess asset returns to the expected excess market returns

-

is the expected return of the market

is the expected return of the market

-

is sometimes known as the market premium (the difference between the expected market rate of return and the risk-free rate of return).

is sometimes known as the market premium (the difference between the expected market rate of return and the risk-free rate of return).

Debt and Equity on the Balance Sheet

Capital from debt and equity is visible on a company's balance sheet. In particular, at the bottom of a balance sheet, a company's debt-to-equity ratio is clearly printed.

Significance

When a balance sheet shows debts have been steadily repaid or are decreasing over time, this can have positive effects on a company. In contrast, when debts that should have been paid off long ago remain on a balance sheet, it can hurt a company's future prospects and ability to receive more credit. What is considered a "normal" debt-to-equity ratio varies slightly by industry; however, in general, if a company's debt-to-equity ratio is over 40% or 50%, this is probably a sign that the company is struggling.

Equity tends to indicate positive financial health for the individual in that it shows an individual's capacity to pay off their debts in a timely manner and move towards actually owning the assets that they have borrowed. For a company, equity is also a sign of health as it demonstrates the ability of business to remain valuable to stockholders and to keep its income above its expenses.

If a company has a high level of debt, it may mean one of two things: the company is either having a bad year because it has been unable to pay back what it owes, or conversely, the company anticipates a very good year ahead and is willing to go deep into debt in the belief that it will profit by far more than it has borrowed.

The latter is a very risky move that may or may not pay off, and so it is relatively rare for companies to take on large amounts of debt at one time. In 2013, when Apple plunged deep into debt by selling $17 billion worth of corporate bonds, it was a big move that is not seen very often. The Wall Street Journal video below discusses Apple's move.

Tax Implications

Debt can be appealing not only due to its simplicity but also because of the way it is taxed. Under U.S. tax law, the IRS lets companies deduct their interest payments against their taxable income. This reduces a company's tax liability.

In contrast, dividend payments to shareholders are not tax deductible for the company. In fact, shareholders receiving dividends are also taxed because dividends are treated as their income. In effect, dividends are taxed twice, once at the company and then again when they are distributed to the owners of the company.

Legal Implications

Selling debt — i.e., issuing bonds — is relatively easy, especially if a company has previously proven its stability and overall creditworthiness. Selling equity, however, is difficult and costly, largely due to regulations imposed by the U.S. Securities and Exchange Commission (SEC).[3]

References

- Debt - Wikipedia

- Complete Guide To Corporate Finance - Investopedia

- Equity Accounts - AccountingExplained

- Long Term Debt and the Debt to Equity Ratio on the Balance Sheet - About.com Money

- Debt Ratios - Investopedia

- What is a debt/equity swap? - Investopedia FAQ

- A Refresher on Debt to Equity Ratio - HBR blog

Income

Income  Stocks

Stocks  Common Stock

Common Stock  Bank

Bank  Qualified

Qualified  Balance Sheet

Balance Sheet

Comments: Debt vs Equity